Watch What Happens When a Debt Buyer’s Collection Practices Are Under Scrutiny

Each time, PRA settled claims that it used illegal, unethical and unprofessional conduct while attempting to collect on portfolios of nonperforming loans it purchased from companies like G.E. Walmart and Capital One Bank. PRA knew the data they purchased was riddled with errors.

Each settlement was about $24 million, and PRA was supposed to cease and desist from the bad conduct. (Spoiler Alert: They didn’t after the first round. I know because they violated the order trying to collect an alleged debt from me.)

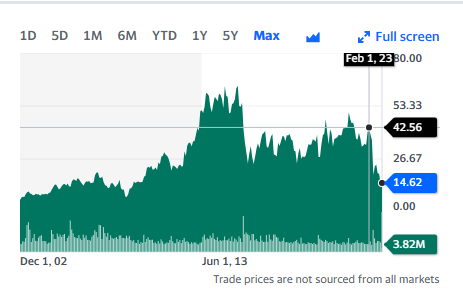

Look at the chart above and try to guess when each settlement was reached.

It is actually a month or two after the fall, September 2015 and March 2023.

Does it look to anyone else like insiders were dumping their stock ahead of the public announcement of the settlements?