Pro Se Motion to SCOTUS Granted: UPDATE: Staff Member Told Me the Motion was Granted In Part

The Motion docketed on October 7, 2024 was titled “Hammett’s Motion to Filed Sealed Documents, Unseal Those Documents and All Lower Court Documents Referred to by the Court in Its Decision”

Hammett gave abundant caselaw supporting the public’s right to access to evidence that was used by the court when deciding to grant Portfolio Recovery Associates’ motion for summary dismissal.

The conclusion of Hammett’s Motion:

“For the reasons stated above, Hammett respectfully requests that the Court grant her motion for public access to the sealed judicial records, unseal Appendices aa, bb, cc, and dd, and require PRA to provide specific justification for maintaining under seal any documents referenced by the district court in its orders granting summary judgment to PRA and denying partial summary judgment to Hammett.

Transparency and fairness in the judicial process demand no less.”

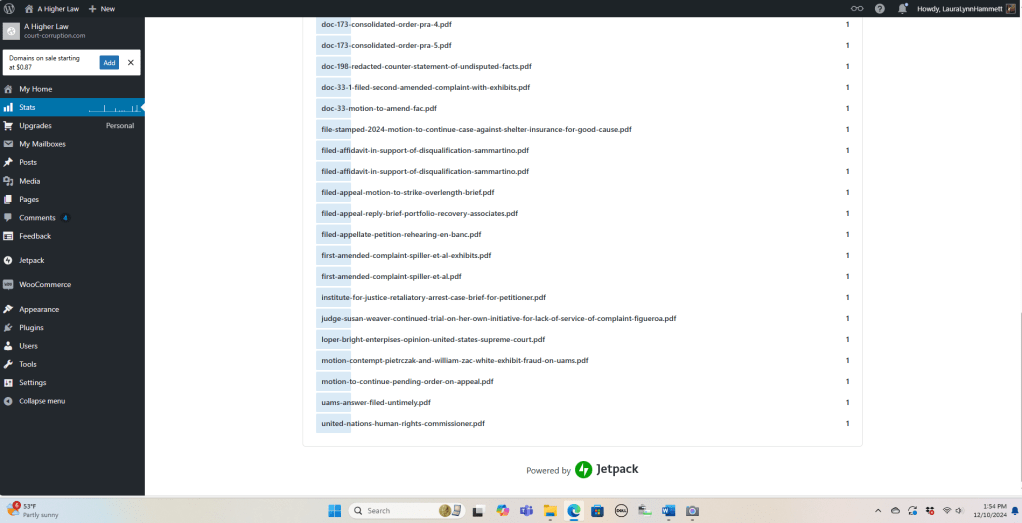

UPDATE: The following four appendices were posted here on December 9, 2024.

Appendix aa

Appendix bb

Appendix cc

Appendix dd

These documents were ordered to be sealed by Federal District Judge Lee P. Rudofsky. The Eighth Circuit affirmed the order.

The United States Supreme Court made a docket entry that did not mention Hammett’s request to unseal the documents. The motion was not available on the SCOTUS website.

Because the Supreme Court Clerk wrote only “motion granted” on the docket on December 9th, Hammett made the reasonable assumption that the motion was granted in full. It is common practice in all other courts for the orders to specify “denied in part” if they are denied in part.

Here is the backstory:

Portfolio Recovery Associates, LLC buys questionable debt from originators for pennies on the dollar. Some of the debt purchased was generated on Walmart branded credit cards. Judge Rudofsky was counsel to Walmart before his lifetime appointment to the bench. He appears to be a puppet for the oligarchy of Big Business.

Portfolio Recovery Associates lied in the proceedings I brought against them, understating the number of times they called me, and making the false claim that they did not call my cell phone in the months leading up to when I recorded a conversation. Purportedly, I turn on my computer, open the camera and record the conversation every time I get a call.

Judge Rudofsky pretended that I had no evidence of PRA’s spoliation of evidence. UPDATE: here is where appendix aa, bb, and dd prove that PRA spoiled evidence by keeping inaccurate, incomplete records of contacts.

Appendix cc proves that PRA and Judge Rudofsky came up with a cockamamie rationalization that failing to issue a 1099-C to me was not proof that the debt was not legitimate. I did not receive one of these forms, but PRA said they “waived” my alleged debt after I filed the lawsuit against them. Judge Rudofsky and the Eighth Circuit pretended that they believed PRA, that I owed the debt and PRA waived the debt without a settlement agreement.

First, why would a script be confidential? This is something PRA representatives repeated to numerous alleged debtors. The reason PRA and their stooge judges wanted it covered up is because it didn’t jibe with PRA’s lie.

Countless debtors have asked: “Why did I receive a 1099-C?” The PRA representative says: “The IRS requires us to file 1099c’s because you either settled your debt, or PRA determined the debt was not collectable and stopped collection efforts.” PRA attorney James Trefil of Troutman Pepper stood in open court and said that the reason PRA did not make a 1099-C against me was that PRA determined the debt was not collectable and stopped collection efforts “in light of the ongoing litigation”. That is the exact reason PRA would be required to file a 1099-C. The reason they did not file the 1099-C is because they knew the debt was not legitimate, and lying to the IRS might get them in trouble. (No such worry existed when lying to Judge Rudofsky and the Eighth.)

The debt buyer is required to file a 1099-C even for disputed legitimate debt. Then the debtor can file for an exemption based on hardship or that they dispute the debt. This is what the IRS says in their instruction booklet.

UPDATE: Whether my petition for writ of certiorari is granted or not, you the public should be able to see with your own eyes that the Federal Courts failed to provide justice, allowed for a Star-Chamber and appear to favor Big Business over individual citizens. Thus far, the Supreme Court is not going to let you, either.

I posted the documents and had numerous downloads. Is there a way to unring that bell?

Hopefully SCOTUS revisits the motion after the petition for writ of certiorari is docketed. But wouldn’t they have made some reference to that procedure on the motion docket??? Seriously, if anyone has experience with Supreme Court procedure, comment or send me a private message to bohemian_books@yahoo.com.

UPDATE December 11, 2024: For some reason unknown to my non-tech mind, the appendices I posted on December 9, 2024 can still be accessed. There was a download of two of them this morning.

Maybe people who receive my blog by email are able to access the files that I deleted on the 10th. I did not receive an emailed copy. I used to get the emailed copies and they did not change after I edited a post.