How the Credit Card Companies and Debt Buyers May Be Ripping Off the Taxpayers.

I am working on my petition for writ of certiorari to the United States Supreme Court, due in the mail by Monday. This passage shows how scrutiny of the debt buying and selling market may result in tightening a loophole and saving our nation a pile of money lost by tax evasion.

According to the Consumer Financial Protection Bureau (“CFPB”), Portfolio Recovery Associates has a practice of buying debt that it knows is invalid. (reference to the consent order in the appendix) The Laura Lynn debt falls into that category.

There is a plausible case of illegal tax fraud arising from this conduct. If credit card companies are selling phantom debt to PRA, and PRA knowingly purchases worthless data (with some legitimate debt interspersed to maintain appearances), both parties could be engaging in tax evasion.

For instance, Capital One claimed an unsubstantiated debt of $2,297.63. PRA likely purchased the data for $229.76, assuming a common rate of 10 cents on the dollar. Capital One then wrote off $2,067.87 as a loss ($2,297.63 minus $229.76). With a corporate tax rate of 21%, Capital One paid $434.25 less in taxes because of the illegitimate debt write-off.

PRA, unable to collect any money from Hammett, wrote off its $229.76 expenditure, reducing its taxable income by $48.25. The People of the United States, through the IRS, lost a combined $482.50 in tax revenue from these two transactions. If repeated across thousands of accounts, this scheme could cost taxpayers millions. Meanwhile, PRA’s business model is sustained by collecting on some of the data, more than offsetting its minimal investment. This setup relies on exploiting a loophole while pretending ignorance of the fact that destroyed records would reveal the disputed debts were never valid.

This scheme only applies to debts that were not created by fraud of third parties, for instance if the Debt was created by Hammett’s former romantic partner frequenting seedy bars and putting his tab on a credit card he intercepted in the mail; but the original account level documentation was destroyed, so there should be an inference that there was no transactional history bringing the balance from zero to $2,297.63.

This case illustrates the systemic impact when aggregated across countless cases, that this conduct could amount to millions in taxpayer losses. This isn’t an isolated incident but potentially a large-scale practice of unverified tax deductions, coupled with a drain on judicial resources and government sanctioned corporate violations of privacy.

It looks bad that the judge on the case was counsel to one of the debt originators who sells to Portfolio Recovery Associates immediately before he became a judge. It will be poetic justice if this tax scheme gains public attention because Judge Lee P. Rudofsky threw the case and Circuit Judges Gruender, Erickson and Stras of the Eighth Circuit rubber stamped his orders.

Judges Worldwide Punish Common Citizenry for Accessing the Courts – Justice for All? Naw.

I challenged the same bad practice early in my case against debt collector Portfolio Recovery Associates. Judge Lee P. Rudofsky, one of the Dark Money boys appointed by Trump, denied my motion.

Every Once in a While, They Weed Out a Bad One

I have some smart-ass comments to make that have to do with Roundup and the courthouse, but am afraid if I write them out loud, I’ll be jailed wrongly.

Apparently, catching the corrupt ones on video sometimes helps attain a semblance of justice.

SPOILER ALERT!!! The cop-tyrant was prosecuted.

The little girl Skylar steals the show.

My prayer is that someday I am able to obtain the audio or Zoom video in hearings held before Queen Susan Kaye Weaver of Arkansas to play them for the public aside the transcripts fictionalized by court reporter Jana Perry. Perhaps then Judge Susan Weaver will be prosecuted for conspiring to falsify court records, the illegal taking of property rights under color of law, and obstruction of justice.

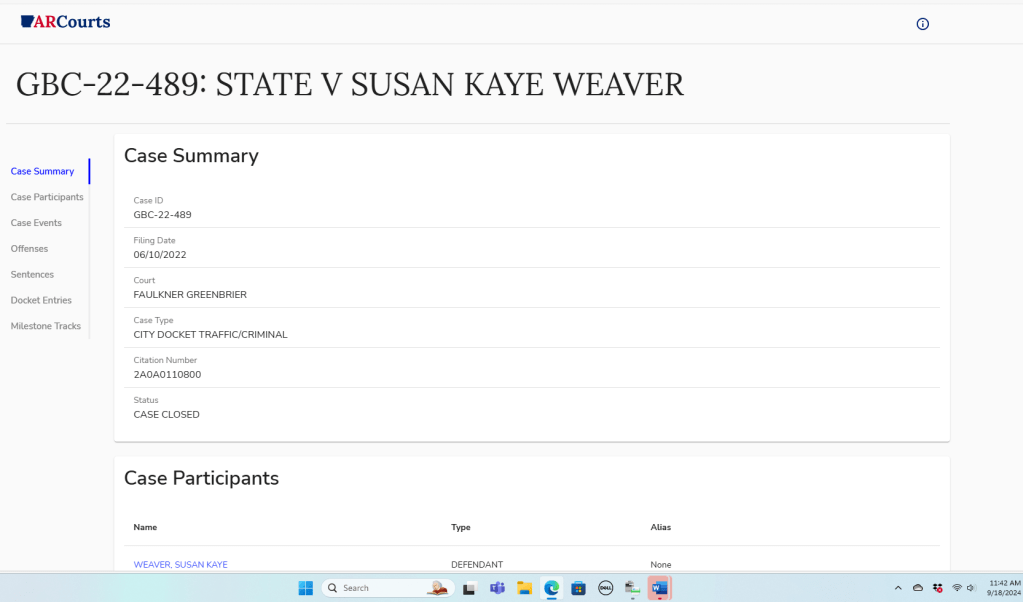

Why Does Arkansas Court Keep Proceedings Against Judge Susan Kaye Weaver Covered-up?

There is a lot of interest in Judge Susan Kaye Weaver of Arkansas Circuit Court on my blog today. So I looked at CourtConnect to see if anything was filed against her.

There was a case from 2022 that had not come to my attention before this. It was apparently a traffic violation for exceeding the speed limit by more than 15 miles per hour.

The problem is, there is scant record of the infraction nor of the opinions by her friend Judge Charles Clawson who presided. The ticket and the orders were not posted. It is customary to see those documents. The case was not designated “under seal” and there is no indication that any procedure was followed to allow for the Star Chamber.

Why is the Public that pays for our courts denied access to simple court documents about a sitting judicial officer?

Welcome to the new world order.

Justice for All. Except the Poor and Middle Class.

There is Walmart branded Capital One credit.

Walmart branded credit card accounts are sold to Portfolio Recovery Associates, LLC, the nation’s second largest debt collector.

Capital One credit card accounts are sold to Portfolio Recovery Associates.

Judge Lee P. Rudofsky’s last job before taking his lifetime seat on the federal bench was counsel to Walmart.

When presiding over Federal Debt Collection Practices Act cases against debt collectors, J. Rudofsky consistently rules against the plaintiff.

When presiding over an FDCPA case against Portfolio Recovery Associates, J. Rudofsky lied about what was written in court documents. He truncated a sentence to change its meaning and ignored evidence that was clearly contradictory to his orders.

This is not a good look for the judge nor the appellate court that upheld his rulings.

Are Our Appointed Judges For Life Really That Stupid, or Just Mean?

This is an excerpt from a motion to file in forma pauperis in the Ninth Circuit Court of Appeals.

It is in response to a question about what issues are on appeal.

The appeal is necessitated by an order issued by Judge Linda Lopez denying my request for a stay of execution of the judgment ordering me to pay the “attorney defendants'” attorney fees on an anti-SLAPP motion. Judge Linda Lopez said I could have the stay, but only if I posted a bond that would cost me about $8,000…if I could qualify at all. I am living on a $644 per month pension, so, even with my 780+ FICO score, a bondsperson might not want to hope for repayment.

*********************************

The Court lacked jurisdiction from the inception, due to lack of diversity. Because Silver Strand Plaza LLC was named as a defendant and the plaintiff is a member of SSP LLC, SSP LLC is a citizen of Arkansas as is plaintiff and there is no diversity of citizenship. The Court and the represented defendants, some who are attorneys, knew or should have known this and should have dismissed or asked to dismiss the case without prejudice.

Pro Se plaintiff, who is not an attorney, fashioned the legal malpractice claim against the attorney defendants in the first amended complaint as a derivative claim. Plaintiff asked for leave to retain an attorney for the limited scope of advocating on the derivative claim. The court denied leave. The Court and the represented attorney defendants knew or should have known that Hammett was forbidden by law from advocating on a derivative claim, yet did not strike or ask to strike on that basis.

Instead, the attorney defendants filed lengthy and repetitive anti-SLAPP motions and motions for attorney fees on the anti-SLAPP motions. When Plaintiff discovered her error she immediately filed a motion to withdraw, specifying the reason was her lack of authorization to practice law. The court granted the motion, then granted attorney fees to the attorney defendants based on the erroneous presumption that moving for dismissal indicated a lack of merits.

This appeal addresses the courts order denying a stay of the judgment for attorney fees unless Hammett posts a bond. Hammett cannot afford to post a bond until her share of SSP LLC is disbursed to her, which is the focus of the suit. The myriad of issues under appeal already may be and should be consolidated with this appeal.

[In answer to a later question, the motion to file IFP ended like this.]

I cannot afford filing fees until I can persuade a court to mandate Mary E. Sherman

and Silver Strand Plaza LLC to disburse my share of the remaining assets that were

embezzled or otherwise remain in the control of the defendants.

UAMS Police Sued for the Deadly Shooting of a Mentally Disabled Man

Researching for my own cases, other tragedies of our failing system of law and order come to my attention. This is one.

Skidmore, Chevron and Loper. Oh my!

My petition for writ of certiorari to the United States Supreme Court is due October 7th.

There are many issues about debt collection that will come to light through briefing at the Supreme Court. It would be a blessing to have advocacy by a public or consumer protection law firm or organization, instead of working alone as a pro se litigant.

The question that is likely to receive cert compares the courts’ treatment of deference to regulatory agencies’ interpretations of statutes, with the vacuum around the interpretation of facts collected by the same regulatory agencies from laborious analysis of Civil Investigatory Demands.

Skidmore, Chevron and Loper Bright Enterprises all deal with the deference given to regulatory interpretations of statutory law written by Congress and regulations written by the agencies. No one (that I can find) has asked that deference be given to analysis of facts that are collected by public agencies, using public tax dollars. This analysis should belong to the People.

Judge Lee P. Rudofsky does not agree. He decided that an alleged debtor who complained that Portfolio Recovery Associates failed to vet the debt, could not rely on the analysis of PRA’s debt collecting practices that addressed portfolios purchased in the same timeframe as the alleged debt. PRA settled the lawsuit that arose from the CFPB’s investigation for over $20,000,000. Judge Rudofsky said there was no reasonable juror who could agree that PRA committed its bad behavior against the alleged debtor, me.

If you are willing and able to practice law in front of the United States Supreme Court or able to fund this effort, please contact me at bohemian_books@yahoo.com.