Sneak Peek at an Appellate Brief

The Eighth Circuit is reviewing my brief for filing.

Here is a sample: (More tomorrow)

Summary of the Case and Willingness to Participate in Oral Argument

Debt Collector Portfolio Recovery Associates’ willful and wanton violation of the FDCPA and a Consent Order injured me. The Court shrugged.

No justice against PRA’s extortionist enterprise was attained. The Court failed.

PRA intruded upon my seclusion, annoyed, and harassed me. Adverse verdicts and settlements against PRA total over $130,000,000 for similar conduct. PRA’s spoliation of evidence shows it knew its pattern and practice was unacceptable.

I sent its calls to voicemail, blocked them, begged these strangers to stop and finally, in November 2020, acquiesced to answering questions on a recorded line. It didn’t help. My only option was to pay an invalid debt or file a lawsuit. I filed.

PRA sent a letter saying it “has concluded its investigation of your dispute and is closing your account” with a balance of zero. Eight months later, for the first time, PRA said the debt had been “waived”. But PRA chose not to issue a form 1099-C.

PRA was allowed to subpoena my entire physical and mental health record, despite the irrelevance, and published false, defamatory accusations against me.

The Court granted summary judgment based on insufficient discovery, PRA’s inadmissible evidence, and disregard of my evidence. The grant of summary judgment is reserved for exceptional cases, emphasizing the court’s preference for full trials and thorough examination of evidence. Please grant me a jury trial.

If it pleases this Court, I will attend oral argument for rebuttal and questions.

Peace and Joy to Y’all,

Laura

Psychopath Judge? Compare Judge Lee P. Rudofsky’s Opinions to the Debtors’ Documents

Judge Lee P. Rudofsky wrote an opinion about me that said I agreed I owed a debt. What?!? I said I had no record of the alleged debt and the creditor had agreed the balance on the account was zero, without a settlement agreement nor issuing a 1099-C.

A little bit curious whether all the other FDCPA plaintiffs that went in front of Rudofsky had similar lies told about them, I pulled up the opinions that were filed on Westlaw.

A search on Westlaw, “(Lee /2 Rudofsky) & FDCPA” in all state and federal yields three cases besides mine.

Rudofsky repeated a phrase, that the FDCPA plaintiffs “took a victory lap” after prevailing on state court collection cases.

In Millwood v. Adams, U.S.D.C. ARED, Case No.: 4:20-cv-01035-LPR, 2021 WL 4466309 Judge Rudofsky wrote: “Ultimately, Ms. Millwood did not have to pay any deficiency under the financing contract”. The Court interpreted my phrase, “I am a consumer in respect to any debt incurred by me” to mean I in fact owed the Debt. Therefore, his meaning in Millwood is that Millwood owed a deficiency and was let off the hook. Inspection of the underlying case, Cannon Finance v. Millwood, Garland County, Arkansas District Court Case No. HTCV-19-1364, August 29, 2019 shows otherwise.

Millwood filed an answer denying she had a deficiency. Cannon, through Adams, dismissed the case voluntarily, three days later, “without prejudice”. (Much like PRA closing my account but leaving some wiggle room to reassert the Debt later.) In the least, Millwood had a genuine dispute about owing a deficiency. Judge Rudofsky refused to acknowledge the genuine dispute.

Judge Rudofsky: “The state court lawsuit could therefore be described as a victory for Ms. Millwood. But she does not see it that way.” 2021 WL 4466309, at *3.

The Court’s repeated opinion is that cessation of collection on a disputed debt, at least temporarily, means the prevailing debtor was made whole. The Court’s opinion is wrong. Ending the harassment is not a complete victory, according to Congress.

Congress intended that debt collector victims be compensated for all the damages caused, and that the errant debt collectors do not keep harassing other victims.

FREE Doc of the Day

Judge Lee P. Rudofsky, Debt Collectors and the Lack of Integrity in Our Courts

Missing y’all.

My appellate deadline to file a brief challenging the majority of Judge Lee P. Rudofsky’s orders on my case against a PRA Group subsidiary was extended to November 27th. Using the extra time to edit and edit again makes the difference between filing a good brief and a make-them-want-to-cry-and-suck-their-collective-thumb brief.

Here is another sneak peek. It is my required a one-page summary of the 287-docket entries in the case.

Summary of the Case and Willingness to Participate in Oral Argument

PRA and the Court do not want the public to hear the facts of this case.

PRA intended to extort payment of a debt I did not owe by annoying and harassing me with incessant, disturbing phone calls.

PRA’s intrusion upon my seclusion was outrageous. Adverse verdicts and settlements against PRA total over $130,000,000. PRA’s spoliation and secreting of evidence shows the company knew its calling pattern was unacceptable.

I sent possibly thousands of calls to voicemail, blocked calls, begged these strangers to stop calling and finally acquiesced to answering questions on a recorded line. The only way to stop PRA was to pay an invalid debt or file a lawsuit. I filed a lawsuit. With no offer, stated waiver or cancellation, PRA agreed the balance was zero. 8.5 months later, PRA swore the correction was a “waiver”.

PRA continued to harass me throughout the proceedings, using the same illegal and unethical litigation tactics that my therapists documented as PTSD stressors. The Court upheld PRA’s subpoenas of my utterly irrelevant sexual history.

The Court denied me equal protection, misstated evidence, misquoted me, denied my discovery motions and allowed PRA to spoil evidence. The Court granted summary judgment based on negative inferences against me, the non-moving party, and ordered me to pay PRA four times the fraudulent Debt in costs.

If it pleases this Court, I will attend oral argument for rebuttal and questions.

God? Karma? A Really Bad Business Model? Why Did the Bottom Drop Out for PRAA Stock?

It was the COVID-Crash and frankly, it seemed like no one might still be around in a year.

Sorry for the lack of variety in cases this past week and until November 6th. I am writing a 13,000 word plus tables and certificates appellate brief against the litigious, vexatious and secretive Portfolio Recovery Associates, LLC, the once golden child of parent company PRA Group, Inc.

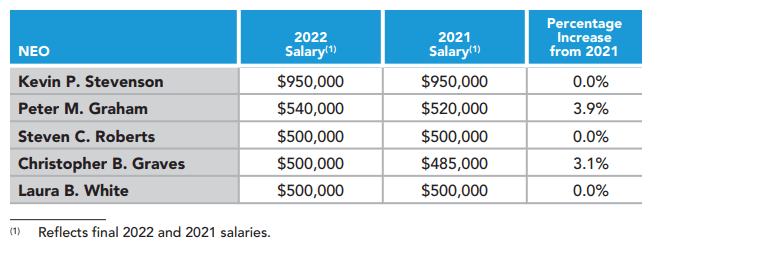

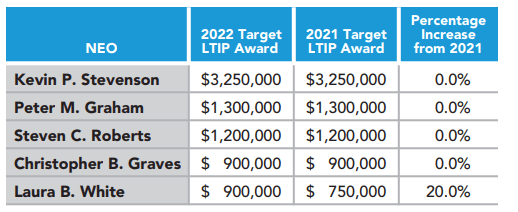

Now it seems like all my work is for naught. The execs at PRA Group, that pay themselves millions of dollars per year, might pack up whatever currency is laying around and leave the building in the dead of night, so to speak.

Why Do Judge Rudofsky and PRA want to Cloak the Evidence in Secrecy?

Your FREE Doc of the Day includes an interesting exhibit “A”.

Knowing that Judge Lee P. Rudofsky was counsel to Walmart right before his confirmation as judge, and that the account PRA was allegedly attempting to collect on was bought from Capital One, the evidence doesn’t have a good look.

Can you say “bias”?

In fairness, here is the opposition Portfolio Recovery filed, arguing that the phone records, account records and written policies that I claim were not followed should remain sealed.

The author, like Judge Rudofsky, did a stint as a young state solicitor general. He must be kinda smart, just to spell his name properly. Misha Tseytlin. I assume he spelled it correctly.

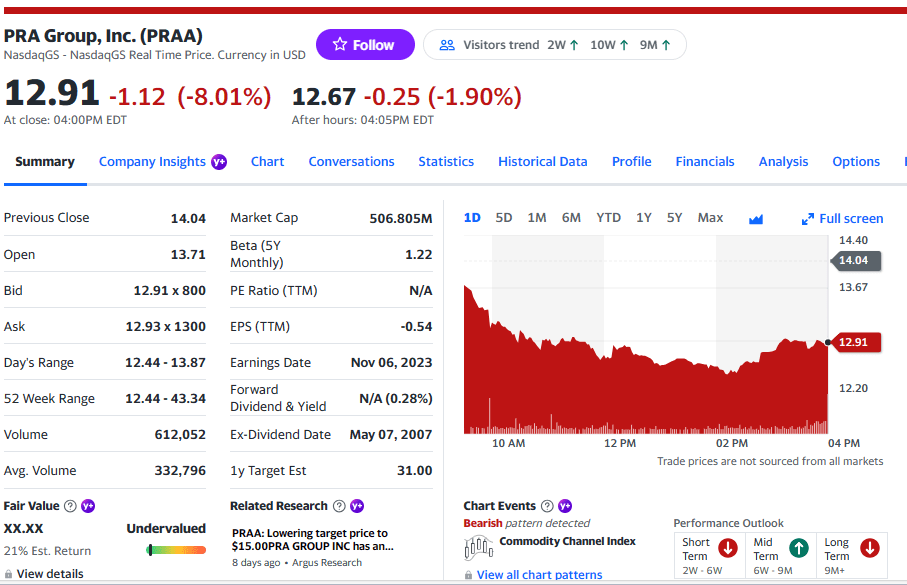

How Low Can PRA Group Go?

One of the first lessons he told me was that when I win a big hand, I’m not supposed to cheer. The other guy just lost a lot of money.

It is so hard for imperfect me not to cheer about the plunge in the price of PRAA stock, an indication of the impending doom of the litigious, vexatious scavengers.

Not that I had anything at all to do with PRA’s loss. They did it to themselves.

I have a case against their wholly owned subsidiary, Portfolio Recovery Associates LLC, that can realistically demand a $82M jury verdict. (The LLC lost that much on a similar case but settled while on appeal.)

If the LLC files for bankruptcy, I am out of luck.

My son and I love to talk about poker, but we take breaks to talk about stocks.

I was gloating about the drop in PRAA and my son went into one of his hysterically funny stand-up comedy routines about the absurdity of PRA’s business model. I can’t capture his timing or colorful language, but here is the basics.

Why would I buy stock in a company that doesn’t have any value?

They buy debts that the debtor doesn’t owe, that the debtor can’t pay, or that the debtor won’t pay.

Most of the people who actually owe the money never should have been approved on those loans in the first place.

Then PRA calls the people over and over again. Like the ex who calls begging to get back together, then threatening, then throwing a tantrum on the front lawn of their obsession’s home.

I agree. PRA counts on annoying their victims into paying, extorting money in exchange for peace.

[Weekend Update]

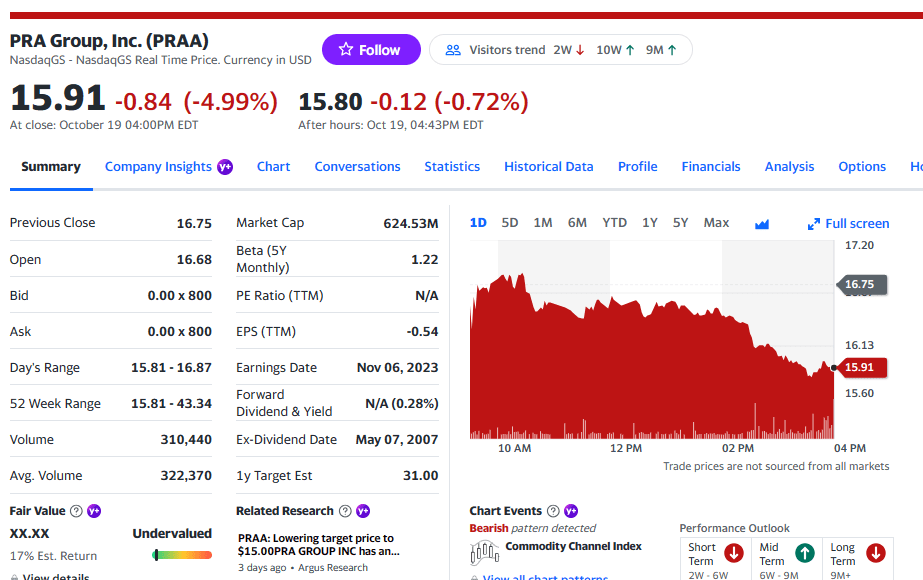

PRAA dropped below Argus’ target on Friday. There must be lots of people out there who agree with me about the value of the company.

PRA Group, Inc Stock, PRAA, Breaks Through Its 10-Year Floor

It is hard to feel sorry for them as they pay their top execs millions per year, while offering their victims $1,000 to settle FDCPA and invasion of privacy cases.

From PRA Group, Inc. 2023 Proxy Statement.

That was two years of heavy litigation ago. Back then, I would have settled for $500,000. When my bloodwork was wack-a-doodle and I could barely get out of bed, I would have begrudgingly settled for $50,000.

But the brilliant risk manager thought it better to spend who knows how much on an army of attorneys to make a point.

Here is some free advice – this is NOT legal advice. I ran a successful real estate sales and development business, and this was my risk management plan. (I was sued only once, in small claims court, because I refused to pay $2,000ish for carpet that was not the color I had ordered.)

- Your word should be your bond.

- Have good documentation to back up what you say.

- Don’t call people who don’t want to be called. Err on the side of caution. (I was a real estate broker and my agents and I made zero cold calls.)

PRA lies.

PRA has lousy documentation, filled with lies.

PRA makes incessant phone calls. When its number is blocked, it calls from another neighbor spoofing number. This conduct gets it sued.

It looks like the stock buying public agrees with me.

Testaliars. What should be the penalty for spoliation and perjury in a civil suit?

“Testaliars” is what Consumer Attorney Jerry Jarzombek calls agents and attorneys representing creditors who frequently falsify affidavits or present erroneous legal documents to the court, according to an article by Deborah L. Cohen published in the ABA Journal called “Pennies on the Dollar”.

“They are scavengers, buzzards picking at the decaying carcass of a debt,” Mr. Jarzombek was quoted as saying.

My appellate brief in a case against Portfolio Recovery Associates, LLC, is due on November 6th. You can read about some of PRA’s dishonesty when it is complete. Unfortunately, the presiding judge, Trump appointee Lee P. Rudofsky, was less than honest in his opinions, as well.

Some of the dishonest statements require discussion of documents that are filed under seal. So, I am working on a motion to unseal those records.

Any brave attorney who wants to help on the case, please contact me at bohemian_books@yahoo.com. You can probably get this case turned around on appeal, and there is a fee shifting provision in the FDCPA. PRA settled with the CFPB with $12M in a fine for doing some of the things I claimed PRA did to me. PRA settled a case similar to mine where the jury awarded $82M in punitive damages.

The sanctions for spoliation of evidence and perjury should be enough to make taking this case worthwhile for an attorney who is ready to retire.

What Would Make Portfolio Recovery Associates Stop Making Annoying Phone Calls? An Open Email to the World’s Most Litigious Debt Buyer

Dear Counsel,

Troutman Pepper is well aware that the bill of sale offered as evidence of the alleged debt was not adequate proof, as I argued, because there was no reference to the -6049 account nor to me.

Assuming my appeal is successful, I intend to inform the jury that I incurred further damages during the pendency of the appeal. These include but are not limited to an increase in anxiety.

My sleep pattern is disrupted again, and I have had only about four hours of sleep per night for about three weeks. The sleep I have is filled with lucid dreams about traumatic experiences that I had buried by 2017.

While awake, I am ruminating on PRA’s implied threat that it will attack my husband, who keeps his finances completely separate from mine, which might cause discord in an amazing marriage.

The Court was wrong when he said suing PRA was my choice. Filing suit caused PRA to set the balance to zero, regardless if it was a waiver with an IRC violation or an admission that the debt arose from a data error or fraud. Filing suit presumably would stop PRA from making further annoying phone calls to me after the 30 day verification period. PRA said it stopped calling the -6000 number in 2013, then started calling it again seven years later.

If you know any other way to get PRA to stop calling a person forever, other than suing Portfolio Recovery or giving them an extorted payment, let me know.

Thank you,

Laura Lynn Hammett

***********************

Please leave your comments below, or email bohemian_books@yahoo.com

A Conversation with Federal District Judge Lee P. Rudofsky

*WARNING! WARNING! This is parody.

The judge’s actual words are in black. I moved whole sentences around a bit. Maybe I should practice law; I already truncate sentences and splice phrases from different paragraphs together. I did change third person to second person “you” statements without using [brackets]. Where I am surmising what Judge Rudofsky is thinking, the text is blue. The way I wish I could write in my appellate brief is in red.

Judge Rudofsky:

Pending before the Court is Defendant PRA’s Motion for Taxable Costs. Pursuant to Rule 54(d)(1) and 28 U.S.C. § 1920, PRA requests $8356.18 in costs. You make numerous arguments as to why the Court should not impose the requested costs. Your arguments are not persuasive. No arguments or reasoning can influence me, because I have a solemn pact to protect the interests of Walmart, and PRA buys billions of dollars of worthless debts from GE Capital Walmart. We gotta get PRA paid. Accordingly, the Court GRANTS PRA’s Motion.

Laura Lynn:

But you are not following the law and you are falsifying the record.

Judge Rudofsky:

I do want to tell you that I am not one of those judges who gets concerned or worried or upset about appeals. I get paid the same whether I get it right or get it wrong. In fact, the cabal gives me extra points if I keep the masses in their place. I’m on the fast track to a position as Grand Poobah.

Laura Lynn:

But, your honor, I am a 61-year-old with severe Hashimoto’s Disease and stress related insomnia. It is difficult for me to take a job, because I never know if I will have the energy to leave the house. I am trying to make money writing, but that is difficult. That is why I didn’t use my bachelor’s degree in journalism right after graduation and worked in real estate instead. I lost all my relatively liquid assets in the COVID-Crash and live on a $639 per month pension.

Judge Rudofsky:

Liar! Elsewhere you state that your monthly income is $630.

Laura Lynn:

I’m sorry. It’s not that I was too tired to look up my deposit receipts or my pinky finger slipped when I reached for the 9. I was trying to keep one extra vegetarian salad at Chipotle each month without reporting it.

Judge Rudofsky:

Plebeian. You also cite to 15 U.S.C. § 1692(k). § 1692 does not have a subsection (k). You mean § 1692k.

Laura Lynn:

I beg your forgiveness. My sister Mary Sherman is right. I am a “moron”.

It seems a little Draconian though, to make me pay more than a year’s pension for the debt buyer’s costs, when I could not afford to pay for the depositions that you said would help my case.

Judge Rudofsky:

You have not shown that you are currently so destitute that awarding taxable costs would be inequitable. You do not note what your expenses are.

I do not believe that you can’t get by on $639 per hour and still pay PRA’s costs. Attorneys like James Trefil get paid half that and pay their bills. Well, maybe not James Trefil, but you understand my point.

Laura Lynn:

But Your Honor, I said $639 per month.

Judge Rudofsky:

That does not create — a more favorable situation for you were this to go to a jury than you had before. In fact, if it does anything, it hurts you, but I just don’t think it makes any difference one way or the — or the other. Notwithstanding your status of a poverty level income, you appear to concede that you have assets of at least $70,000 in a capital account.

Laura Lynn:

Your Honor, (exasperated), that money is being held by my sisters who refuse to dissolve a family-owned limited liability company that has no purpose to exist, other than to hold my capital. That is what one of my 12 lawsuits over a lifetime is about. That Court, Judge Linda Lopez, said that my sisters are using reasonable business judgment to decide that my capital is assets of the company and dissolution is not required as long as the company holds assets.

It is on appeal.

Judge Rudofsky:

Oh, that is wonderful. I’m sure Linda appreciates you appealing. I think it’s a great part of our system and, quite frankly, it makes me feel better that there are other judges looking over my shoulder who can tell me if they think I got it right.

Laura Lynn:

What if they think you got it wrong?

***************************

Please consider helping me defray the costs of appealing this order. I am considering framing a question to SCOTUS: When a federal district judge, who cannot be fired according to the will of the people, dismantles the FDCPA, is he making an unconstitutional power grab?

You can CashApp a donation to $CoolOldStuff. Or contact me at bohemian_books@yahoo.com. Especially if you can contribute free legal representation or know an organization that pays filing fees for people who can’t qualify as in forma pauperis. Thank you. (This is a gift to an individual, not a 501(c)(3) nonprofit organization.)