Satan and Federal Court Judge Lee P. Rudofsky

No, I am not saying Judge Lee P. Rudofsky is Satan or the Anti-Christ.

I am just saying that we can learn a lesson by comparing the two.

Judge Rudofsky has now granted Portfolio Recovery Associates motion for me to pay their costs of defending against a lawsuit arising from incessant phone calls PRA made in an attempt to collect money I did not owe to them.

Along the way, Judge Rudofsky twisted words, lied, deceived and may have orchestrated the falsification of a transcript. I will detail my claims in my appeal and in other posts on this blog. Here is the big picture.

Judge Rudofsky is incredibly intelligent.

He studied at Cornell. He studied at Harvard. He lived in Israel for a year, and I presume he speaks Hebrew well. He writes in English with a silver “tongue”.

But intellect is not an indication of integrity. And Judge Rudofsky lacks integrity.

He lies. He deceives. He has no compassion nor empathy for the ordinary person.

He is a dangerous man.

(Being dangerous can be taken as a compliment of sorts. Sometimes I call my husband “cute”. Then I playfully correct myself. “I mean you look sexy and dangerous.” Judge Rudofsky should not take my comment about him as a compliment.)

Here are a few verses about Satan taken from the King James Version that remind me of Judge Lee Rudofsky.

Genesis 3:1

Now the serpent was more subtil than any beast of the field which the Lord God had made.

2 Corinthians 11:14-15

And no marvel; for Satan himself is transformed into an angel of light.

Therefore it is no great thing if his ministers also be transformed as the ministers of righteousness; whose end shall be according to their works.

1 Peter 5:8

Be sober, be vigilant; because your adversary the devil, as a roaring lion, walketh about, seeking whom he may devour:

2 Corinthians 11:3

But I fear, lest by any means, as the serpent beguiled Eve through his subtilty… [which refers to Genesis 3:4-5) And the serpent said unto the woman, Ye shall not surely die: For God doth know that in the day ye eat thereof, then your eyes shall be opened, and ye shall be as gods, knowing good and evil.

And Eve fell for it. Be on your guard. When you read orders written by Judge Rudofsky, know that he is tweeking the truth, whether through subtle deception or outright lies. If your case is disambiguated from the plaintiff who failed in front of Judge Rudofsky, the Judge may fictionalize the evidence to fall under the precedent that fulfils his agenda.

His agenda is to please those who control the most money, in exchange for prestige, power and possessions.

2 Timothy 3:13

But evil men and seducers shall wax worse and worse, deceiving, and being deceived.

Matthew 7:15-17

Beware of false prophets, which come to you in sheep’s clothing, but inwardly they are ravening wolves.

Ye shall know them by their fruits. Do men gather grapes of thorns, or figs of thistles?

Even so every good tree bringeth forth good fruit; but a corrupt tree bringeth forth evil fruit.

Judge Rudofsky’s fruit is evil. He presided on a case filed by a self-represented, low-income, sickly woman against a billion-dollar debt buyer. He admittedly misquoted the plaintiff to say she agreed she owed a debt, ignoring the score of clear and concise statements that the woman did not owe the debt. He refused to let a jury decide.

The woman told the judge that all her assets other than those that are protected in bankruptcy were lost or taken from her since COVID-19. She showed that her efforts to re-enter the workforce by reviving her writing career resulted in a loss, at least in 2022. She said that she went to other courts to try to recover some of those assets but lost at the trial court and is on appeal. (Only 20% of appeals are successful and the number by self-represented litigants approaches zero.)

Judge Rudofsky ordered the woman, me, to pay over a year’s pension in costs anyhow. This is not a direct quote, but to paraphrase, he said “let her eat cake.”

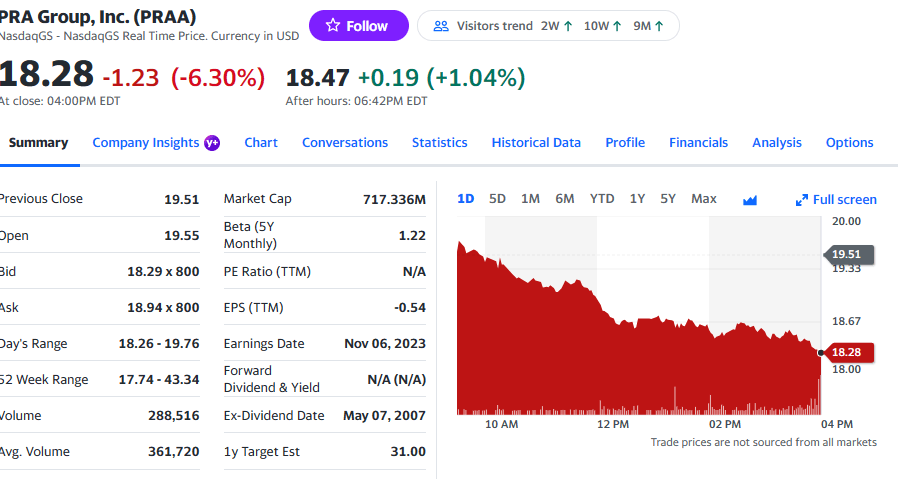

Friday Funday: PRA Group, Inc., symbol PRAA Takes a Dump

Graph clipped from Yahoo Finance.

Have a nice weekend, y’all.

UPDATE from Hump-day.

How Low Can PRAA Go?

Are Judges Approving Tax Evasion on Debt Collector Portfolio Recovery Associates’ Cases?

Excerpt of class action settlement from Pollak et al v. PRA:

“PRA will provide, without imposing any condition or charge whatsoever, a credit to each account belonging to a Non-Zero Balance Class Member (“Account”), in an amount not to exceed the outstanding balance of each Account, up to $500.00 per Non-Zero Balance Class Member and collectively up to $1,092,000.00. No cash payment will result from any credit provided to a Non-Zero Balance Class Member’s account(s), and PRA agrees not to issue any Non-Zero Balance Class Member a form I099-C due to the credit.“

The PRA Group, Inc. subsidiary emphasized, toward the beginning of the settlement agreement, “PRA has denied, and continues to deny, each claim and allegation of wrongdoing Plaintiff alleges in the Litigation. PRA also has denied, and continues to deny, inter alia, any allegations that Plaintiff or the Settlement Class suffered any damage whatsoever, were harmed in any way, or are entitled to any relief as a result of any conduct on the part of PRA as alleged by Plaintiff in this Litigation.”

In the case I filed against PRA, they denied, denied, denied. Judge Lee P. Rudofsky agreed with PRA. He said I owed money to PRA and no reasonable juror would disagree with him. But PRA lawyers from Rose Law Firm, Troutman Pepper and PRA big-wig Meryl Dreano all told the judge that Portfolio Recovery set my balance to zero as a “waiver” and had no intention of filing a 1099-C due to the waiver.

Judge Rudofsky winked at PRA and said, you’re right, setting the balance to zero was a “waiver”, but don’t bother complying with the tax code. That is just for the little people.

The Pollak plaintiffs were not suing for the misrepresentation of the amount or character of a debt. They alleged that the notorious debt collector sent letters threatening litigation with no intent of litigating.

The amount per plaintiff in Pollak is under the mandatory reporting requirement of $600. The money is still taxable, and the aggregate is over a million dollars. There are other tax rules I’ve noticed where the IRS discourages breaking up payments into many small chunks as to evade detection from the IRS of what is one giant transfer of wealth, in the hopes the transfer can be made tax free. The instructions for 1099-C say: “Do not combine multiple cancellations of a debt to determine whether you meet the $600 reporting requirement unless the separate cancellations are under a plan to evade the Form 1099-C requirements.” (emphasis added) It is probably worthwhile for the IRS to investigate the number of recipients of these $500 settlements who reported the gain. This is tippy toe right up to the line. Maybe our law makers can add a few more words to the tax code. Perhaps, “all class action settlements must be reported on the new form 1099-CA.”

At least in my case, PRA could have been crediting my account to zero because I did not owe the debt, as I claimed, in which case they were not conspiring and encouraging what they believed was tax evasion. But no, PRA insisted that it was a waiver and therefore they must admit they had the intent of orchestrating tax evasion. (I’ve already informed the IRS about what transpired.)

One attorney who served PRA on both cases was James Trefil. How many other cases did Mr. Trefil participate and counsel the defendant debt buyer and convince the Courts to ignore the Internal Revenue Code?

(If you know judges who approved settlements of $600 or more per debtor with no 1099-C issued, inform us in the comments or send the case info to me at bohemian_books@yahoo.com. If you send a file stamped copy of the agreement, it will be posted as a Doc of the Day.)

FREE Downloadable Documents from FDCPA Case

My appellate brief challenging Judge Lee P. Rudofsky for granting summary judgment to defendant Portfolio Recovery Associates is due in about 49 days.

I need to file a motion to change privacy designations soon, so don’t have time to chat with you, my dear readers.

In lieu I am offering to you two documents pulled from PACER yesterday.

One is my reply to my motion for partial summary judgment. The gist is that when a debt collector agrees to zero out an account without an order from a court and does not issue a 1099-C cancellation of debt, the debt collector is admitting that the person named on the account is not liable for the alleged debt.

Portfolio Recovery Associates claimed that it just decided to zero out the debt “in light of the litigation”, and they admitted that my claim that I owed no debt was made in “good faith”, but Judge Rudofsky interpreted that to mean PRA “waived” the debt.

The second document talks about why the business records that showed my account details should not be kept confidential. Judge Rudofsky allowed for me to make the comment about the waiver and 1099-C issue, but made it clear that if I step over the line he will hit me with paying the debt buyer’s attorney fees.

If you have business documents generated by PRA that are not ordered confidential by a court, please share them with other readers by emailing a copy to bohemian_books@yahoo.com. Together we can show that, as the CFPB complained, PRA lying on affidavits in court and making collection efforts on an invalid debt is commonplace and therefore awards and settlements on state cases and FDCPA cases against Portfolio Recovery should be much higher than the usual $1,000 or $5,000 they get away with.

Find Clues Even in the Mundane

Today’s Doc of the Day might look at first glance to belong in the giant to file pile.

Lawyers come and go. Especially in a mega firm like Troutman Pepper. And it is commonplace to have an appellate law specialist handle an appeal, if one can afford one.

The name of Portfolio Recovery Associates, LLC’s attorney who will handle the appeal I filed against the debt buyer intrigued me. So, I ran it through a Dogpile search.

If you run the name I used for two decades through a search engine, you would get hundreds or thousands of pages of results. Laura Lynn is popular as a first and middle name and as a first and last name. Especially for strippers. lol. I’m not kidding. I once tried and found I was in the wrong business.

Misha Tseytlin, not so common.

It was easy to discover that the attorney PRA brought on for the appeal writes for the Harvard Law Review, is a mucky-muck at the Federalist Society and was the first Solicitor General for the State of Wisconsin. Plus, he is the head appellate attorney at Troutman-Pepper.

At first glance, that is pretty intimidating.

But analyze the meaning. The PRA Group subsidiary came out the chute claiming the case was worth no more than $5,000 plus minimal costs. They put that claim in writing in an OOJ – an Offer of Judgment – before any discovery was done.

PRA has an inhouse legal department with a few thousand employees. They hire outside firms for many of the 3,000 cases they file per week in the United States.

If they think a jury would award a mere $5,000 if the judge lets the case go to a jury, why would they use anyone other than a flunky to handle the case against a 60-year-old layperson who has a health condition that saps her energy?

Well, I am that woman. Brain fog or not, my educated guess is that PRA is afraid of losing another $62,000,000 punitive damage award. And they should be.

****Fun Facts***

Judge Lee P. Rudofsky who presides on the case also wrote for the Harvard Law Review, also is entrenched in the Federalist Society, and was the first Solicitor General for the State of Arkansas.

The Irony: Federal Judge Complained that Head of CFPB Is Tough to Fire

Thank you to the good people at the Alliance for Justice for providing the Doc of the Day.

This article “from the desk of Leslie Rutledge” was a Statement of Joint Quarters with input from Federal District Judge Lee P. Rudofsky.

Judge Rudofsky seems to be on an unconstitutional power grab of his own. It is nearly impossible to remove a Federal Judge, which appears to some judges to be a license to lie from the bench and throw cases.

Read a Deposition Taken by Portfolio Recovery Associates and Decide for Yourself if the Case Should Have been Dismissed Summarily by Judge Lee P. Rudofsky

While you are reading, answer these questions:

- Might a reasonable juror think it more probable than not that I owed no debt to PRA? Judge Rudofsky said no reasonable juror can think that PRA bought a debt that was a clerical error or incurred by a fraudster.

- Did I, as Judge Rudofsky said, admit to incurring the debt?

- Did I present testimony that the many calls made by PRA were annoying to the point that they coerced me to tell them my personal identifiers in order to make the calls stop? Or should we allow PRA to call people, not identify themselves and demand the person called identify herself, as Judge Rudofsky ordered?

And, out of curiosity, do you think that the protection against improper search and seizure offered by the 4th Amendment applies only to search and seizures by the government, as Judge Rudofsky interprets it? Do you think you must identify yourself to everyone who asks you to, as long as the inquisitor is not dressed like a police officer?

I think Judge Lee P. Rudofsky’s opinions are preposterous.

If you are a consumer advocate who wants to fight the summary dismissal of my FDCPA claim at appeal, please contact me at TheNext55Years@gmail.com or Bohemian_books@yahoo.com.

Don’t Let Portfolio Recovery Associates Bully You

You try to sue PRA Group, Inc’s wholly owned subsidiary for misrepresenting the amount or character of a debt it tried to collect. Or, you owed a debt, but asked PRA to stop calling you and it refused. Or, as with me, PRA refused to identify itself meaningfully, unless you would answer interrogatories on a recorded line.

Instead of letting a jury decide what the damages are, PRA tries to bully you into settlement. Most plaintiff’s attorneys who work on contingency suggest you settle for $1,000 or $5,000 and they collect $25,000 in attorney’s fees. That doesn’t seem right to you.

When you refuse to settle for the set amount, PRA digs into your personal life and makes thinly veiled threats to share your personal information with the world. The litigious debt buyer might “accidentally” post your unredacted credit report online. They did that to me. They might tell the world that you have no social security number, like they did to Guadalupe Mejia. Ms. Mejia was awarded $250,000 in emotional distress and $82 Million in punitive damages by a jury, so PRA does not always get away with their bad conduct.

If there is nothing really juicy to use to blackmail you into settlement, PRA just makes shit up. They invented a story about me that I am a degenerate poker player who lost everything playing in illegal games online. The truth is that I play like a nitty old lady and the vast majority of the time I play for fake money starting with the free promotional chips on Zynga and Poker Bros.

Please don’t give up.

Report the abusive litigation conduct to the CFPB. When you begin your report, you will be asked to choose from several categories of bad conduct. Taking advantage of uneven bargaining power in an FDCPA case is not an option. What I did was to choose one of the things that led me to file my suit. Then I told the CFPB in the opening of my narrative that my main concern was the bullying during my lawsuit.

Judge Lee Rudofsky who presided on my case is anti-consumer and anti-CFPB. His decisions forced me into appeal. Looking through all my filings in preparation reminds me of the pain PRA inflicted on me in an attempt to continue business as usual. Here is one document that you can download FREE.