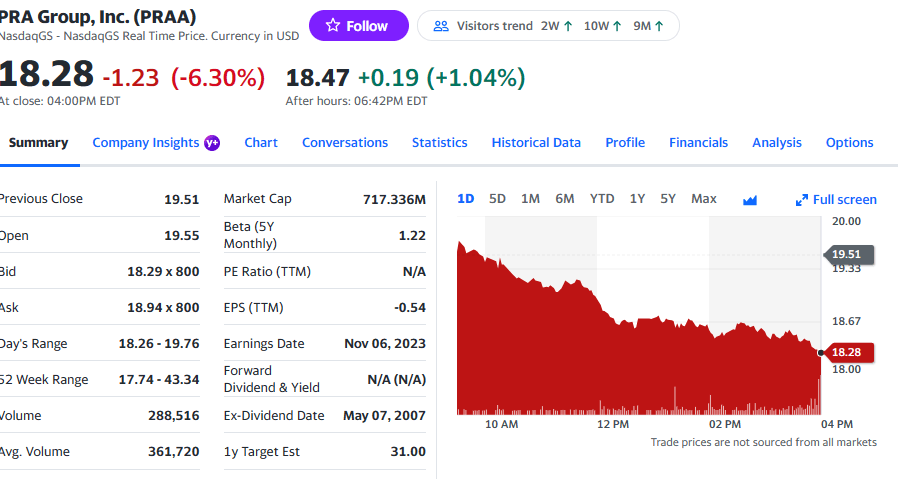

Judge’s Pet, PRA Group (PRAA), Owner of Unethical Debt Collector, Stock is Stuck!

When I filed my lawsuit against Portfolio Recovery Associates in 2021, its parent company PRA Group, Inc’s stock was selling around $20 per share. Today it sold for $13 plus change.

I don’t mean to be a schadenfreudist, but watching PRAA’s stock nosedive genuinely made my day. Maybe true schadenfreude is about undeserved suffering — and this isn’t that. This is earned misery. PRAA is a pet litigant of Federalist Society cabalist Judge Lee Rudofsky, and if justice exists, this is just the beginning of their bad news.

PRA Group, Inc. Spends Nearly $100,000,000 this Year on Legal Collections and Calls Me “Litigious”

“Why Is PRA Group (PRAA) Down 10.9% Since Last Earnings Report?”

– – Quote from Zacks Research on Yahoo Finance today.

Portfolio Recovery Associates, a wholly owned subsidiary of PRA Group, Inc. (symbol PRAA), spent at least $8,000 in costs and hired two premiere law firms to defend against my allegations of wrongdoing that PRA said would be worth no more than $5,000 if it went to a jury. The CFPB made similar allegations against PRA in March 2023, that PRA did to millions of people what it did to me, and PRA settled for about $24 million.

These defense costs are a drop in the bucket compared to the money the debt buyer and collector spends on legal collections. According to SEC filings, the amount spent on lawsuits against alleged debtors approaches $100 million per year. According to the deposition of a PRA representative, the company wins 90% of its cases by default.

The litigious nature of PRA Group companies is one issue that may affect investors’ perception of PRAA stock value.

Another issue, that is not immediately related to this blog is PRA Group’s propensity to borrow.

SEC filings as reported by Zacks show PRA Group has $4.3 Billion in assets and $2.7 Billion in borrowings. Do the total assets reflect the face value of the junk debt PRA purchases for pennies on the dollar?

Court documents in another case involving a different debt buyer show that an industry standard is about an 11% rate of collection on the face value of portfolios.

If you know whether PRA or debt buyers in general report assets as face value or expected revenues, please leave a comment or send a private email to bohemian_books@yahoo.com. Designate the email “background only”, “anonymous” or “for attribution”.

The reason PRA’s borrowing may become pertinent to this blog soon is that a low actual value of assets to borrowing rate is likely to lead to bankruptcy court. In bankruptcy, PRA’s portfolios would be sold to other debt buyers. And the new buyer would continue the cycle of churning junk debt by collecting from individuals who don’t have law degrees or teams of attorneys to protect them from abusive debt collection practices.

Friday Funday: PRA Group, Inc., symbol PRAA Takes a Dump

Graph clipped from Yahoo Finance.

Have a nice weekend, y’all.

UPDATE from Hump-day.

How Low Can PRAA Go?

Judge Lee P. Rudofsky Cover-up of Litigation Misconduct

Judge Rudofsky in the Federal District Court of Eastern Arkansas gave summary judgment to the defendant in my FDCPA and Invasion of Privacy case against Portfolio Recovery Associates, LLC yesterday.

I tried to apologize about my blog posts to Judge Rudofsky during my closing arguments at a telephonic hearing. The judge, who is usually polite, cut me short. He said not to apologize and explained that he values the First Amendment.

Some advice I got from my sister Roberta Kramer who was an attorney, is to always accept a compliment. If someone says you look nice today, don’t retort, “Oh no! I have this big zit on my nose!”

My corollary is, always accept an apology.

It is not easy for a person to apologize. It helps the person who is apologizing. You may find your common ground with the apologetic person. And it may help you to understand your contribution to the conflict.

For example, if a husband says, “I am sorry I was so grumpy today when we were driving in that horrible traffic”, the respectful wife will accept his apology. “Thank you, my love. It was frustrating, and it was kind of you to keep me company. I know how much you hate driving in a busy city.”

So, here is my apology in full.

I am sorry for any embarrassment or disrespect Judge Rudofsky feels from my posts.

That does not mean that I wrote or intend to write anything false or malicious. As he recognized, I have not written anything threatening.

It is like this. Once when my son was about four years old, we were walking in the supermarket parking lot. There were two morbidly obese people walking in front of us. My son shrieked in his loudest voice, “Look how fat they are Mom!”

OMG. I was mortified. Even remembering the story, my face gets red from embarrassment. I am sorry my son said that.

But they were fat.

There was just no advantage to my son speaking his observations out loud. Not that loud.

There is, hopefully, a good purpose for me to write about corrupt, unethical, or plain stupid acts by judicial officers. Even though most citizens have lost faith in our legal system, there is still a chance we can bring it back to what it was meant to be. A way to provide justice for all.

So, here is today’s exposé.

In the litigation, the lawyers for Portfolio Recovery lied. For example, James Trefil of Troutman Pepper (AKA Troutman Sanders) said PRA changed the balance on my account from $2,297.63 to zero “in light of the litigation”. He expanded by saying the debt was “waived”. But there was no 1099-C cancellation of debt issued within the time required by the IRS.

It is PRA’s known practice to issue 1099-Cs when it cancels a debt. Even if the debtor disputes the debt. Do a Dogpile search of “Portfolio Recovery Associates issued me a 1099-C” and you will find plenty of reading to fill your spare time.

Judge Rudofsky was not persuaded by what he called the “inference” that can be made from that. The judge said no reasonable juror can think that PRA set the balance to zero and did not issue a 1099-C because their investigation showed there was no credible evidence the debt was mine. In fact, he said the debt was mine. (That is a subtle error that I will address at the Court of Appeals. It is telling that Judge Rudofsky is well aware of the subtle difference when establishing PRA’s innocence on my case. He knew it was my burden to prove the debt did not exist on an FDCPA claim but ignored that the debtor’s lack of proof is not enough to establish there was a debt in a case against the debtor.)

Worse, PRA submitted business records that were falsified. I pointed out some of the falsifications. Judge Rudofsky ignored those obvious fraudulent exhibits.

Worse, I cannot give you specifics. I cannot post two documents created by PRA with conflicting data side by side. Because Judge Rudofsky allowed the fraudulent documents to be filed under seal.

Before yesterday’s hearing, the jury was out on Lee P. The jury is now in.

It sorrows me to say, guilty.

Email: bohemian_books@yahoo.com

Non-confidential Settlement Offer to PRA (a Wholly Owned Subsidiary of PRA Group, Inc.)

I am quite upset right now because I am thinking about that awful week leading up to March 16, 2020. The stock market crashed and I was heavily invested.

The reason I am thinking about this horrible time is because of my research into PRA. I see that on May 9, 2023 the value of PRA Group, Inc. stock fell over 30%.

Apparently it is getting harder for PRA to bluff and bully people into forking over money that PRA has no credible evidence is owed.

I am thrilled that the CFPB prevailed in the lawsuit filed March 23, 2023 against PRA.

I am angry that PRA Group, Inc. executives got paid several million dollars each while the publicly traded company was poised to lose money.

I am concerned that PRA will use the entire $2.6 billion dollars of credit extended to it, a good portion by Bank of America, and then file for bankruptcy. Not only has an attorney representing PRA, Mr. James Trefil, filed for bankruptcy, but the parent company has subsidiaries that service consumer bankruptcy accounts in the USA. PRA is certainly not adverse to using that tool to avoid paying its debts.

Besides that I would need to learn to navigate the bankruptcy court as a creditor, by the time we go through appeals to SCOTUS, I don’t know that I can still collect even a part of the jury verdict that I anticipate.

I am therefore willing to settle for $1,000,000.

This offer is good until June 15, 2023.

Sincerely,

Laura Hammett

Email: bohemian_books@yahoo.com