Anatomy of a Bankruptcy: How a debt collector’s defense attorney dug himself in so deep.

It is difficult to listen to Portfolio Recovery Associate’s lead attorney, James K. Trefil of Troutman Pepper spew lies, downplay the spoliation of evidence and insinuate that I owed a debt of $2,297.63 to Capital One, when I know he got himself deep in debt and then filed for bankruptcy while bringing in an $11,000 per month income. It seems like a somewhat sociopathic case of transference.

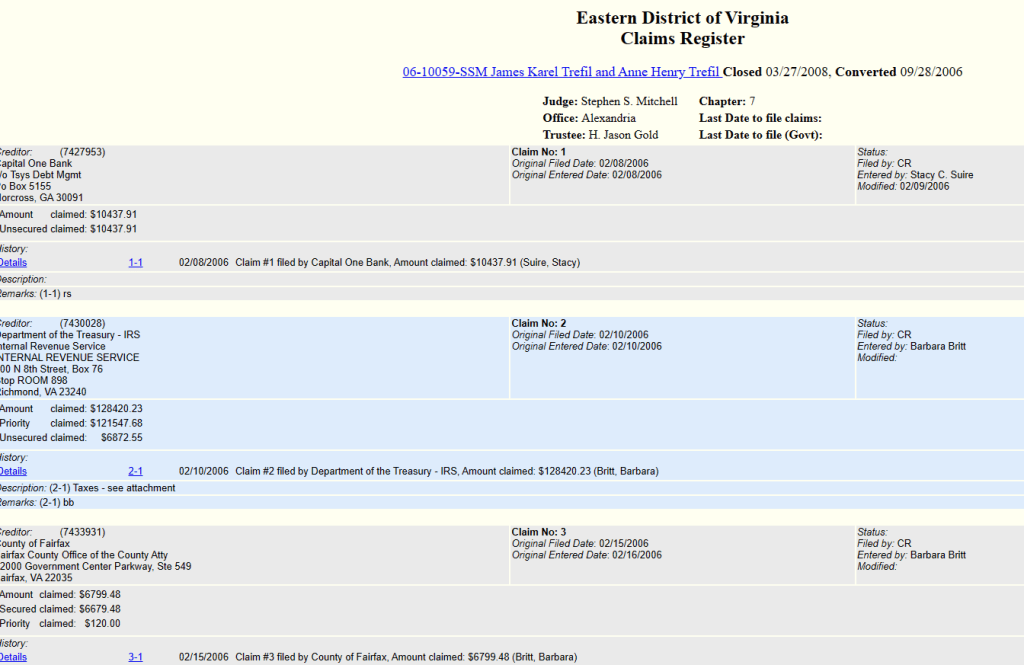

Ironically, as you can see in the claims register found on PACER, $10,437.91 of Mr. and Mrs. Trefil’s debt was owed to Capital One. It would be a hoot if the same debt that was extinguished in bankruptcy also appeared on one of the portfolios the bank sold to Mr. Trefil’s client. The portfolios purchased by PRA are known to be riddled with errors, according to the CFPB (Consumer Financial Protection Bureau).

Hopefully you find looking at a bankruptcy case novel and interesting. I cannot afford to pull up all the documents on PACER. If you have an account and don’t usually hit your $30 per quarter worth of free docs limit, please download more of this case and send copies to me. I’ll share with the class.

(If corrupt judicial officers keep ruling against me, and the appellate courts fail to correct them, I may need to file for bankruptcy myself. The Trefil case is probably a good template to learn from. It was filed by an attorney on behalf of an attorney.)

From what I posted below for you to download FREE, there is a picture of a lawyer living beyond his means. Imagine that. If you are an ordinary person, you probably wonder how a couple earning six figures with one child can spend all that money, and then some.

To start, their mortgage for a townhouse was $4,875 per month. In 2006.

Geez! In 2006 I lived in a cool old beach house in California with a whitewater view and paid $1,600 per month. That place was big enough to work from home and give two kids their own rooms.

Sometimes it is better to rent than to buy, like in the overheated market early this century.

The Trefils also carried $70,000 worth of credit card debt and line of credit of $47,981.

Oddly, the value of their consumer goods owned was less than $17,000 and they drove a Honda Accord worth $6,150.

Sadly, they paid over $700 per month for health insurance and still had medical bills they were responsible for of almost $35,000.

Still, that just does not add up. I have similar personal property, and less than 1/10th the income. My trick is buying everything I can find at yard sales.

What caused me to go into this lawyer’s bankruptcy with you, my friends? Well, his team is now claiming that I should pay the costs of litigation for the billion-dollar company (that has a $2.6B credit line available) because, even though my only income last year was a $630 per month pension, I have debilitating illnesses, lost $500,000 of my own working capital in the COVID-Crash and had to fight a dozen court cases pro se, I undoubtedly have enough assets left over to pick up the bill.

After James Trefil filed for bankruptcy, he had at least 17 more years to earn income and has a healthy social security account built up.

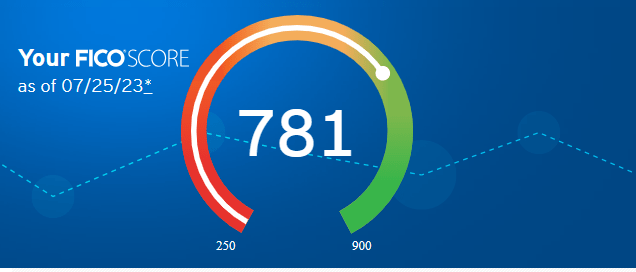

Screenshot of the Author’s FICO score today.